Swiping a credit card to pay for a purchase seems simple enough, but the industry behind that simplicity is more complex than it looks.

| 2019 Q1 | story by Emily Mulligan | photos by Steven Hertzog

The cash register is an endangered species. There is no longer a place in retail stores or restaurants for a glorified calculator with a drawer. Instead, touch screens and interconnected point-of-sale systems have taken over, and one local company has almost 20 years of experience with that robust industry.

It seems like a straightforward business, to sell machines and software that process customers’ payments for a store or restaurant: Insert the credit card, catalog the payment and the bank should handle the rest, right? But between varying credit card fees, multiple employees and, of course, very pressing data security concerns, the payment processing and point-of-sale (POS) industry is much more complex than it appears.

Griffith Payments is a Lawrence company that sells and services payment solutions nationwide.

“I can’t even describe to my mother what it is I do. This is not something the general public understands because it’s so behind-the-scenes,” owner Mark Griffith says.

Griffith Payments specializes in both the hardware, for which it partners with Harbortouch, and the software, with various partners, involved in processing, encrypting and securing payments.

The purpose of the payment solution business, of course, is for businesses to get paid for the goods and services they provide. Employees need paychecks, the light bill is due every month, and the only way to have money for those things is from customers.

“If people want to give you money for something you’ve done, make it easy for them to pay you,” Griffith says. “Sitting there waiting for checks in the mail doesn’t cut it.”

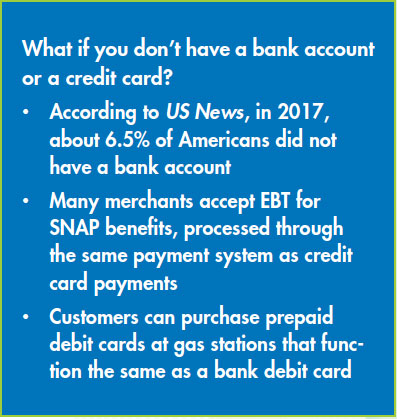

Griffith Payments offers every kind of option imaginable for customers to be able to pay businesses—and some options that, truthfully, are not even imaginable because they are so specialized. Griffith’s core business is based around creating a “credit card merchant account”—in other words, allowing merchants to accept credit cards. The two main ways Griffith creates credit card merchant accounts are through touch screen POS systems and online payment gateways.

Mark Griffith of Griffith Payments in his downtown Lawrence office

Since its inception in 2000, Griffith has developed software tailored to many specialties, including restaurants, bars, retail shops and salons and spas. The POS allows for employees to log in and place orders, set appointments and track inventory. Business owners also can generate reports as specific as they like in any number of categories, or even categories they invent themselves. Bookkeepers can track credit card fees, taxes and tips, in addition to revenue and costs. The bar software allows patrons to run a tab. The retail software can create a gift registry or track a layaway purchase.

Katie Moore owns the downtown kitchen store Delaney & Loew and has been a Griffith customer since the store opened in 2016.

“We have 10,000 items in the store to keep track of, and it’s so easy to ring up a sale or do a return. Every employee we’ve had, every time I’ve trained them, their first response is, ‘That’s easier than I thought.’” she says.

Payment gateways can either take the form of a traditional online payment “button” or donation “button,” or they can involve more sophisticated Bluetooth methods of transferring payments in a mobile setting. Griffith Payments can establish an e-commerce site or network for the smallest businesses and nonprofits to large-scale online operations. The Griffith network also offers telephone banks for secure payment over the phone or options for selling event tickets online. When a customer is paying with a paper check to a mobile business, Griffith has a system that can process and deposit the payment using just a photo of the check taken by the employee.

Mark Griffith of Griffith Payments going over new software with owners Katie and Brad Moore of Delaney and Loew Kitchenalia

Rueschhoff and Mobile Locksmiths take advantage of several of Griffith’s payment options to help keep them nimble and make things convenient for their customers.

“Getting paid on a job today is so much more simplified. In the past, we had to hope they had cash or that their check was good,” says Don Stowe, co-owner of Rueschhoff and Mobile Locksmiths.

Rueschhoff’s customers can pay their monthly bills online thanks to Griffith’s “pay invoice” button on its website. Customers who have locked their keys in their car or locked themselves out of their house can pay the technician with a credit card on-site using Bluetooth payments or the mobile chip reader on the technician’s phone. And out-of-town customers, such as a parent who wants to pay his college student’s locksmith bill, can submit the payment over the phone using one of Griffith’s secure phone banks. An email receipt is generated instantly, which Stowe says gives the parents peace of mind.

With massive data breaches making news, Griffith’s clients are very concerned about keeping their customers’ data secure. Mark Griffith notes that none of Griffith Payments’ customers have ever had a large-scale data breach on the company’s equipment or software.

“Bad guys are looking at smaller and smaller places. Now, they don’t need an infinite number of credit cards to cause trouble, they just need 10 credit card numbers they can sell. I spend about 10 to 15 percent of my time dealing with potential fraud issues,” Griffith says.

There are many layers to Griffith Payments’ data security, starting at the POS itself. Employers can limit which employees can do which operations on the POS—voiding transactions, for example. With access control and the ability to run back-end reports on individual employees, bosses can keep information secure at the retail level.

Above the store level, the payment industry has what it refers to as the “security trifecta,” which Griffith Payments provides. The first element to the “trifecta” is EMV, which stands for Europay MasterCard Visa, better known as the chip card. The second element is “tokenization,” which is the encryption of sensitive data at the point of sale. That means the actual data never touches the point-of-sale system; rather, it is sent separately over the internet. And the third element is point-to-point encryption, which is de-encrypting the data at the other end. Without any one element of the “trifecta,” there is not complete data security.

On top of the “trifecta,” Griffith Payments offers what is called Payment Card Industry (PCI) compliance. In PCI compliance, the practice is to purposefully make data intrusion attempts, at least annually, against each customer to make sure the network is secure. If the intrusion is successful in some way, Griffith Payments notifies the customer of the network’s deficiencies and works with them to correct them.

The other aspect of security is that the network has multiple power and internet redundancies, so the system will not fail or go down for long periods.

Although the security is of utmost importance, there are a lot of reasons Griffith Payments has been able to differentiate itself from competitors and succeed in the industry for 19 years.

Rueschhoff Locksmith and Security Systems use payment systems from Mark Griffith

For one, Griffith is a hometown company, with offices in downtown Lawrence. Local merchants and companies know Mark Griffith personally, and many call him directly with even the seemingly smallest of questions.

“Having somebody that’s here in town is pretty awesome. Mark came in and did the POS system update himself. Having him be right there and making sure everything was up and running—man, that’s hard to come by,” Delaney & Loew’s Moore says.

Mark Griffith insists—and it is clear—that the Lawrence location is just one of the many reasons local merchants use Griffith’s services.

“We invest in the hardware, software and training at no cost to the customers. What’s in it for us is the monthly service and the ability to process credit card sales,” he says.

Griffith has searched, vetted and assembled a top-notch team of nationwide contractors to handle the various aspects of the POS and payment systems. Businesses have true 24/7 phone support and can talk to a live person. The tech support and customer service can log in to the POS remotely and see exactly what is happening or what the question is, and adjust it right then.

Any size of business or nonprofit is within the scale of what Griffith Payments can provide. From one-person, part-time entities to global, multinational operations, Griffith has a product or service that is cost-effective and efficient for that business.

He says that, interestingly, demand for payment services has stayed strong, regardless of how the economy has performed. When the economy is strong, new businesses are opening, and current businesses are expanding their scope, Griffith grows with that. But when the economy is bad, surprisingly, that is also a time that new businesses get started. Griffith says he knows countless customers who have lost a job, only to capitalize on the opportunity to open their dream businesses.

Because of that stability and growth potential, the future looks bright for Griffith Payments. The security aspect of the business is ever-changing, so that will be a continually evolving process, staying ahead of the hackers and thieves. Other trends that are starting to unfold are the integration of mobile wallets, such as Apple Pay and Google Pay, as well as the presence of RFID (radio-frequency identification) chips in credit cards.

Within the calendar year, Griffith hopes to launch a new service that will make online food ordering and delivery more seamless for restaurants. Right now, a restaurant has to have a separate tablet to tabulate online orders from services such as Grubhub and DoorDash—many restaurants have as many as three tablets in addition to their POS for that purpose. Griffith says his company is very close to complete touch-screen integration of all of those companies with Griffith-run POS.

For now, there is never a dull moment or an idle day at Griffith Payments, and Mark Griffith wouldn’t have it any other way.

“I chose a life of being in service to other people when I was a little kid, and I’m so grateful to be of service,” he says.