| story by | |

| photos by | Steven Hertzog |

The economic impact of Lawrence car dealerships is undeniable, as are the stable, well-paying jobs they provide to community members.

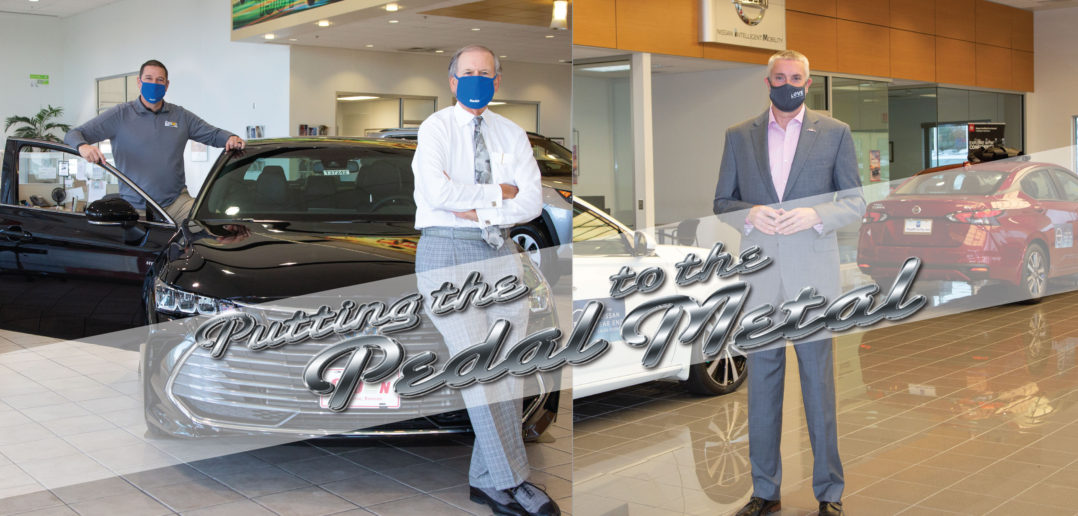

Left: Miles Schnaer and Randy Habiger on the showroom floor at Crown Toyota of Lawrence; Right: Karl Kramer, Chief Marketing Officer for McCarthy Auto Group

Covering as much ground, literally, as some of the largest businesses in town, Lawrence car dealerships make their presence known not just with rows of shiny vehicles lining some of our busiest streets. As large employers and some of the largest generators of sales tax revenue, their economic impacts cannot be understated.

New and used vehicle sales in Lawrence accounted for more than $2.1 million of sales tax revenue in Douglas County in 2018 and more than $2.5 million in 2019, according to the Kansas Department of Revenue. People come from both nearby and outside of the county to shop for and purchase vehicles from local dealerships. That is in addition to hundreds of customers per day whose cars are serviced and repaired at those locations.

The local auto dealerships, according to Lawrence Chamber of Commerce data, employ about 600 people in sales, service, collision repair and parts, which means they are a significant source of stable, well-paying jobs in what was defined earlier this year as an “essential” business.

Crown Automotive and McCarthy Auto Group are longtime, stalwart auto industry companies that are cognizant of their roles in the local scene.

Crown Automotive, 3400 Iowa St., is a Toyota and Volkswagen dealer providing service, collision repair and parts, as well as selling pre-owned vehicles. Miles Schnaer has owned Crown since 1994, when he purchased the Chevrolet dealership near the same location. Crown employs more than 100 people and sells about 250 new and used cars per month, while servicing about 140 cars per month, Crown general manager Randy Habinger explains.

McCarthy Auto Group is a regional Kansas City-area organization, in business since 1969, that owns 11 dealerships and acquired the Lawrence Subaru, 2233 W. 29th Terrace, and Nissan, 2101 W. 29th Terrace, from Briggs Auto Group in July 2019. McCarthy Subaru and Nissan also provide service and pre-owned sales, and employ about 50 people between them, says Karl Kramer, chief marketing officer for McCarthy Auto Group. McCarthy Subaru sells an average of 70 to 80 new and pre-owned cars per month, which makes it one of the top five fastest-growing Subaru retailers in the Midwest, Kramer says. McCarthy Nissan sells an average of about 50 vehicles per month.

Crown’s 80-vehicle showroom, service and collision facilities, and Kingdom Event Space for community events opened in 2004. It was built adjacent to the old 15-car showroom, on the site of the former Payless Cashways store, when Walmart purchased the older building as part of its expansion to become a Walmart Supercenter. The new facility allowed Crown to grow from selling about 70 to 100 cars per month with 30 employees to more than double the sales and more than triple the workforce, Habinger says. Schnaer sold the Chevrolet brand store to Dale Willey in 2009. That same year, he purchased both the Volkswagen and Toyota stores.

Both McCarthy’s Subaru and Nissan facilities are newer and updated, Kramer says. Briggs Auto Group built the Subaru building in the Lawrence Auto Plaza in 2012 and remodeled it in 2017, when Briggs also purchased a nearby building that it converted to a used car showroom. Briggs Nissan built its facility in the Auto Plaza in 2013 after moving from the former Sears building on Iowa Street. McCarthy Nissan has 12 to 14 service bays, and McCarthy Subaru has 11 service bays, Kramer explains. McCarthy also owns the digital time and temperature sign on Iowa Street, which has been updated to reflect the McCarthy brand. It also shares with Dale Willey the tall, grandfathered directory sign that lists the various dealerships and other businesses along that Four Wheel Drive corridor.

clockwise: Crown Toyota in the early morning; Crown detailing one of their cars; Quilt show in the Kingdom; Crown Service area; Crown sales person demonstrates some of the bells and whistles to a client

A Different Direction

Displaying cars in showrooms is the traditional way of demonstrating vehicles to customers; but nowadays, that seems a little quaint. Most of the information customers learn for their car purchase comes from the internet and is prior to arriving at the dealership. Even local stores must develop their own unique web presence, replete with vehicle specs, pricing and even live chat and methods to develop “e-leads,” which can put customers in direct touch with local dealership salespeople.

“The internet has changed the industry for good,” Crown’s Habinger says. “Now the consumer comes in educated, and they know what they want. Even people on the internet want to come in and drive, and try the vehicles … .”

Habinger says there’s about a 5 percent segment of the buying market that is willing to purchase vehicles fully online, which has increased, likely temporarily, during the COVID-19 pandemic.

One of the first things McCarthy Auto Group did when it was transitioning from Briggs was update the website and online presence to reflect McCarthy’s identity, Kramer says.

Even with a stellar website and social media presence, the auto dealerships agree that in Lawrence, their reputations in the community are what supersede any kind of marketing effort.

“When a customer knows we’re going to be here long-term, that makes a difference. We’ve dug our roots in this community. People come here because they know we stand behind our community and our business,” Habinger says.

The Crown dealership, in pre-COVID times and hopefully in the near future, opens its built-in event space to local nonprofit organizations for fund-raisers and community activities. Many nonprofits use the space for annual events that benefit their organizations and the community.

Kramer says a combination of having solid reputable brands like Subaru and Nissan, and jumping right into philanthropic activities in Lawrence has allowed McCarthy to start off on the right foot in terms of being new to Lawrence. In 2021, McCarthy has a large slate of local organizations it plans to support, and Kramer also hopes to launch a high school scholarship program in Lawrence similar to others that McCarthy has established in other markets.

The internet isn’t the only aspect of car dealerships and vehicle sales that has changed over time—in particular, during the past 10 years or so. The technology inside the vehicle itself is adapting continually for safety, entertainment and comfort. Where the attraction of newer models used to be a new body style or fuel economy, Habinger says that now, it is also about touch screens, Bluetooth and high-tech security features, such as backup cameras and automatic emergency braking systems.

The vehicles people are choosing to drive also have changed dramatically through the years. Even as recently as the 1990s, he says, about 70 to 80 percent of the vehicles on the road were passenger cars; now, the road is dominated by SUVs, trucks and minivans, with passenger cars accounting for only about 30 percent of the vehicles.

“With the fuel economy of SUVs and trucks, plus the comfort of sitting up higher from the road in those vehicles, it has really changed what the consumer wants,” Habinger adds.

clockwise: McCarthy Auto Plaza; Karl Kramer visits with sales people; Mechanics at McCarthy work on a car; McCarthy Auto group service area; Checking on the computer

Cars in the Time of COVID

For all the obvious reasons, business has not been as usual at the car dealerships in town this year. The businesses had to balance both customer safety and employee safety as they addressed social distancing within the facilities and additional cleaning and sanitizing procedures in common areas.

When the shutdowns began in March, vehicle repair was considered an essential business by Kansas Gov. Laura Kelly. In May, Kramer says vehicle sales came to be part of the essential businesses, as well.

Habinger says Crown was open by appointment only, and the service department went to half of its staff in order to keep to social distancing guidelines. The garage doors were left open throughout the workday. The sales staff was at one-quarter of its usual staffing.

Both Crown and McCarthy continued to have web traffic as people researched cars, but they had to take some time to accommodate in-person shopping, test drives and negotiations. During the shutdowns, Habinger explains, people choosing to purchase their cars fully online and have them delivered—a completely no-contact sales process—increased from about 2 to 3 percent of overall sales to about 5 percent.

Subaru and Nissan manufacturers temporarily stopped producing vehicles in March and April, Kramer says. McCarthy managed its used vehicle inventory through the summer until more inventory began arriving in August. They were “definitely feeling the crunch” of having fewer new vehicles on hand in the early summer, he adds.

Between pent-up demand for vehicles and generous manufacturer incentives, Habinger says, the year in sales at Crown likely will end up being average. Even better, by changing the staff to a rotating three- or four-day workweek during the shutdowns, Crown did not have to furlough any employees or cut pay.

“What we started 25 years ago is customer service. The way we built the organization is to take care of the customer. When the downturn happens, we adjust,” he says. p

![]()