City of Lawrence: GASB STANDARDS

Lawrence Ahead of Curve With GASB Standards

| 2017 Q2 | story by Britt Crum-Cano, Economic Development Coordinator, City of Lawrence

Each year, the City of Lawrence publishes a comprehensive annual economic development report for review by the City Commission. This year, for the first time, standards are in effect that require state and local governments to provide reporting for tax-abatement incentives. These standards have been established by the Governmental Accounting Standards Board (GASB).

Each year, the City of Lawrence publishes a comprehensive annual economic development report for review by the City Commission. This year, for the first time, standards are in effect that require state and local governments to provide reporting for tax-abatement incentives. These standards have been established by the Governmental Accounting Standards Board (GASB).Lawrence is way ahead of the curve, having published a comprehensive economic development report that surpasses the GASB requirements since 2011.

The 2016 Annual Report: Economic Development Support and Compliance, reviews the annual performance of economic development programs, participating projects and the public funds distributed for them during the year. In addition to city contributions, a summary of county-only economic development programs is also included.

Report highlights include four 2016 property tax-abatement projects that met all compliance requirements, delivering:

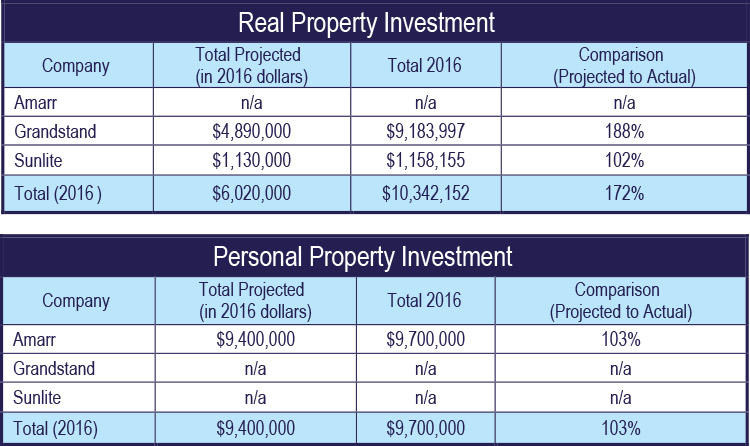

Report highlights include four 2016 property tax-abatement projects that met all compliance requirements, delivering:• 72% more real property capital investment than projected ($6 million projected, $10.3 million delivered)

• 3% more personal property investment than projected ($9.4 million projected, $9.7 million delivered)

• 162% more full-time jobs than projected (142 projected, 372 created)

• 24% higher wages than projected ($32,094 projected, $39,802 paid)

• average wages $8,480 higher than the private community wage

• average wages $13,594 higher than the community wage floor

In addition, these property tax-abatement projects paid $194,837 in property taxes out of a total $341,955 due in 2016 ($147,117 abated).

Of the city’s seven authorized Neighborhood Revitalization Areas (NRA), five were eligible for rebates, with rebates totaling $110,300 for 2016. After rebates, taxing jurisdictions realized an average of 18.6% more real property tax revenues in 2016 compared to if these five properties had been left in original condition.

Nine companies had Industrial Revenue Bonds (IRB) in 2016, the majority of which were not affiliated with a property tax abatement but, rather, were utilized to obtain a sales tax exemption on project construction materials.

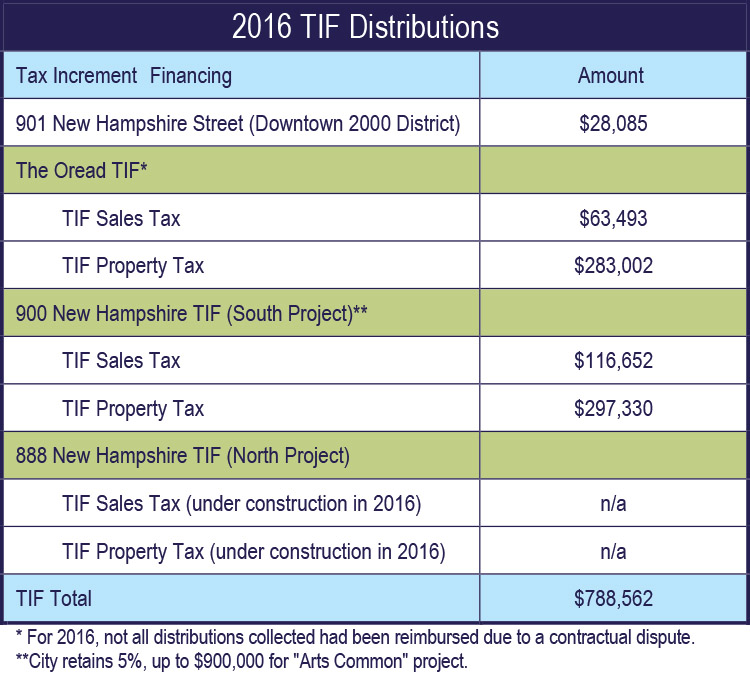

The city continues to support three Tax Increment Financing (TIF) districts and three Transportation Development Districts (TDD).

• Downtown 2000 TIF—funds 10th and New Hampshire city-owned parking garage

• Oread TIF and TDD—partial reimbursement for public and transportation improvements related to The Oread Hotel project

• Ninth and New Hampshire TIF & TDD—partial reimbursement for public and transportation improvements in South Project area (Hotel) and North Project area (mixed-use)

• Free-State (Bauer Farm) TDD—partial reimbursement for transportation improvements in Free-State development area

TIF distributions were approximately $788,600, and TDD distributions were approximately $278,700 in 2016. (Not all amounts distributed for The Oread project were reimbursed in 2015 and 2016 because of a contractual dispute.)

Overall, 2016 PAYGO (pay as you go) programs provided approximately $4.69 in private-sector capital investment for each $1 of public-sector assistance provided.

Overall, 2016 PAYGO (pay as you go) programs provided approximately $4.69 in private-sector capital investment for each $1 of public-sector assistance provided.In addition to the PAYGO programs, the report also reviews direct public support provided for economic development services and projects, including grants, loans, capital investment, operations funding, relocation assistance, affordable housing, infrastructure assistance, technical education and workforce training.

New this year, the report presents a brief overview of the economic climate for the community, profiling jobs, wages and the balance between commercial and noncommercial community assets.

The City Commission received the report at its meeting on April 4, 2017, and referred it to the Public Incentives Review Committee (PIRC) for review and recommendation at its April 17, 2017, meeting. It then received the report and PIRC recommendation at its May 2, 2017, meeting and voted to accept it.

For more information, please contact Britt Crum-Cano, economic development coordinator, at 785-832-3472 or bcano@lawrenceks.org.